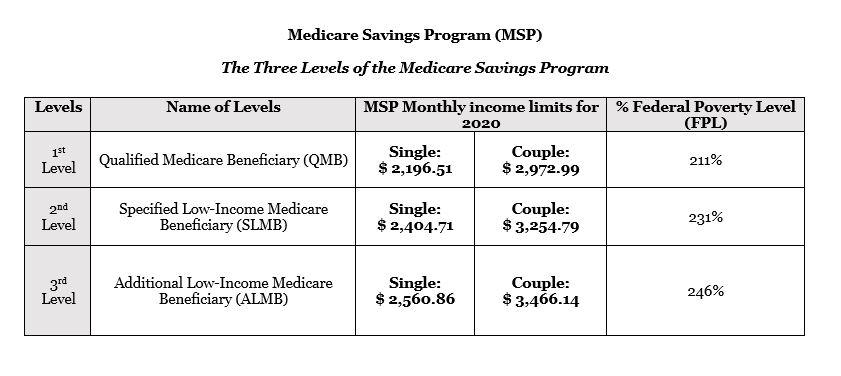

On April 7, 2020, Eli Lilly announced the introduction of the Lilly Insulin Value Program, allowing people without health insurance and people with commercial health insurance in the United States to fill their monthly prescription of Lilly insulin for $35 per month through a new copay card. The Low Income Subsidy (LIS) helps people with Medicare pay for prescription drugs, and lowers the costs of Medicare prescription drug coverage. How can I help people get the LIS? We work with our partners to find and enroll people who may qualify for the LIS, and we encourage local organizations to tell people in their communities about it.

Medicare Part D: A First Look at Medicare Prescription Drug Plans in 2021

Juliette Cubanski Follow @jcubanski on Twitter and Anthony Damico

Published: Oct 29, 2020

During the Medicare open enrollment period from October 15 to December 7 each year, beneficiaries can enroll in a plan that provides Part D drug coverage, either a stand-alone prescription drug plan (PDP) as a supplement to traditional Medicare, or a Medicare Advantage prescription drug plan (MA-PD), which covers all Medicare benefits, including drugs. Among the 46 million Part D enrollees in 2020, 20.2 million (44%) are in PDPs and 19.3 million (41%) are in MA-PDs (excluding the 7.0 million (15%) in employer-only group PDPs and MA-PDs). This issue brief provides an overview of Medicare Part D drug plans that will be available in 2021 and key trends over time.

Part D Plan Availability

The Average Medicare Beneficiary Has a Choice of Nearly 60 Medicare Plans with Part D Drug Coverage in 2021, Including 30 Medicare Stand-alone Drug Plans and 27 Medicare Advantage Drug Plans

Figure 1: The Average Medicare Beneficiary Has a Choice of Nearly 60 Medicare Plans Offering Drug Coverage in 2021, Including 30 Stand-alone Drug Plans and 27 Medicare Advantage Drug Plans

A larger number of Part D plans will be offered in 2021 than in recent years. The average Medicare beneficiary will have a choice of 30 stand-alone PDPs in 2021, two more PDP options than in 2020, and eight more than in 2017, a 36% increase (Figure 1). Although the number of PDP options in 2021 is half of what it was at the peak in 2007 (when there were 56 PDP options, on average), this is the fourth year in a row with an increase in the average number of stand-alone drug plan options.

In 2021, beneficiaries will also have access to 27 MA-PDs, on average, a 71% increase in MA-PD options since 2017 (excluding Medicare Advantage plans that do not offer the drug benefit and plans not available to all beneficiaries; overall, an average of 33 Medicare Advantage plan options will be available in 2021).

Based on September 2020 enrollment, 8 out of 10 PDP enrollees (80%) in 2021 are projected to be in PDPs operated by just four firms: UnitedHealth, Centene (which acquired WellCare in 2020), Humana, and CVS Health (based on PDP enrollment as of September 2020). All four firms offer PDPs in all 34 PDP regions in 2021.

Figure 2: A Total of 996 Medicare Part D Stand-Alone Prescription Drug Plans Will Be Offered in 2021, a 5% Increase From 2020 and a 34% Increase Since 2017

A total of 996 PDPs will be offered in the 34 PDP regions in 2021 (plus another 11 PDPs in the territories), an increase of 48 PDPs (5%) over 2020, and 250 more PDPs (a 34% increase) since 2017 (Figure 2). This increase is primarily due to the Trump Administration’s elimination of the “meaningful difference” requirement for enhanced benefit PDPs offered by the same organization in the same region. Eliminating this requirement means that PDP sponsors no longer have to demonstrate that their enhanced PDPs offered in the same region are meaningfully different in terms of enrollee out-of-pocket costs. In 2021, 62% of PDPs (618 plans) will offer enhanced Part D benefits—a 60% increase in the availability of enhanced-benefit PDPs since 2017, when just over half of PDPs (387 plans) offered enhanced benefits.

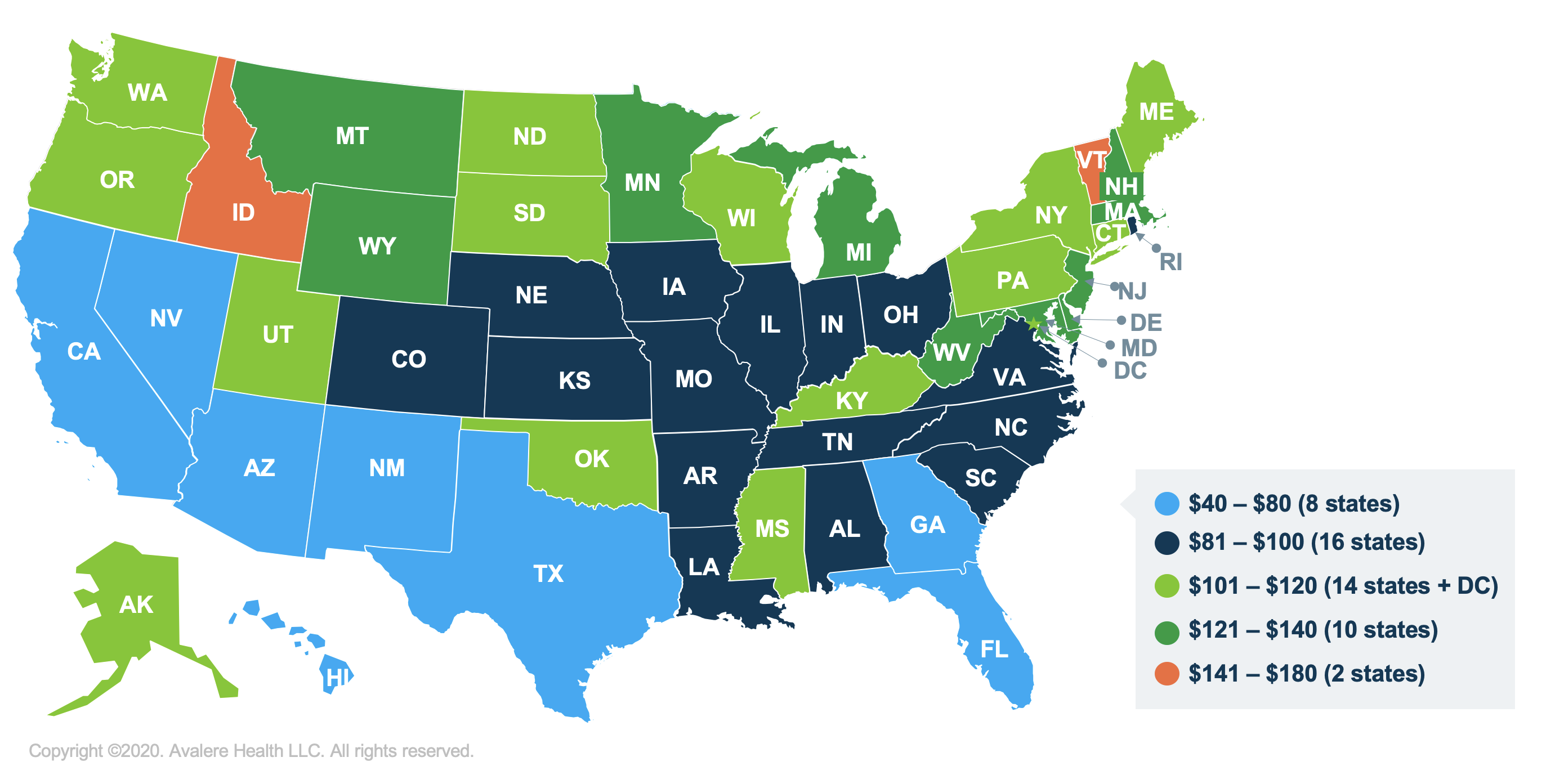

The number of PDPs per region in 2021 will range from 25 PDPs in Alaska to 35 PDPs in Texas and will be the same or higher in 32 of the 34 PDP regions compared to 2020 (see map, Table 1).

Part D Premiums

The Estimated Average Monthly Premium for Medicare PDPs Is Projected to Increase by 9% to $41 in 2021, Based on Current Enrollment

Figure 3: The Estimated Average Monthly Premium for Medicare PDPs Is Projected to Increase by 9% to $41 in 2021, Based on Current Enrollment

The estimated national average monthly PDP premium for 2021 is projected to increase by 9% to $41, from $38 in 2020, weighted by September 2020 enrollment (Figure 3). It is likely that the actual average weighted premium for 2021, after taking into account enrollment choices by new enrollees and plan changes by current enrollees, will be somewhat lower than the estimated average. CMS reported that the average premium for basic Part D coverage offered by PDPs and MA-PDs will be an estimated $30 in 2021. Our premium estimate is higher because it is based on PDPs only (excluding MA-PDs) and includes PDPs offering both basic and enhanced coverage (enhanced plans, which account for 62% of all PDPs in 2021, have higher premiums than basic plans, on average).

Average Monthly Premiums for the 21 National Part D Stand-alone PDPs Are Projected to Range from $7 to $89 in 2021, with Higher Average Premiums for Enhanced Benefits and Zero-Deductible PDPs

Figure 4: Average Monthly Premiums for the 21 National Part D Stand-alone Drug Plans Are Projected to Range from $7 to $89 in 2021

PDP premiums will vary widely across plans in 2021, as in previous years (Figure 4, Table 2). Among the 21 PDPs available nationwide, average premiums will range from a low of $7 per month for SilverScript SmartRx to a high of $89 per month for AARP MedicareRx Preferred.

Changes to premiums from 2020 to 2021, averaged across regions and weighted by 2020 enrollment, also vary widely across PDPs, as do the absolute amounts of monthly premiums for 2021.

- The 1.9 million non-LIS enrollees in the largest PDP, CVS Health’s SilverScript Choice (which had a total of 3.9 million enrollees in 2020, including those receiving low-income subsidies) will face a modest $1 (2%) decrease in their average monthly premium, from $29 in 2020 to $28 in 2021.

- In contrast, the 1.8 million non-LIS enrollees in the second largest PDP, AARP MedicareRx Preferred, will face a $10 (12%) increase in their average monthly premium between 2020 and 2021, from $79 to $89. This is the highest monthly premium among the national PDPs in 2021.

- The 1.3 million non-LIS enrollees in the fourth largest PDP, Humana Premier Rx, will see a $7 (13%) increase in their monthly premium, from $58 in 2020 to $65 in 2021.

Most Part D stand-alone drug plans in 2021 (62% of PDPs) will offer enhanced benefits for a higher monthly premium. Enhanced benefits can include a lower (or no) deductible, reduced cost sharing, or a higher initial coverage limit than under the standard benefit design. The average premium in 2021 for enhanced benefit PDPs is $51, which is 55% higher than the monthly premium for PDPs offering the basic benefit ($33) (weighted by September 2020 enrollment).

In 2021, a large majority of PDPs (86%) will charge a deductible, with most PDPs (67%) charging the standard amount of $445 in 2021. Across all PDPs, the average deductible in 2021 will be $345 (weighted by September 2020 enrollment). The average monthly premium in 2021 for PDPs that charge no deductible is $88, nearly three times the monthly premium for PDPs that charge the standard deductible ($34) or a partial deductible ($31) (weighted by September 2020 enrollment).

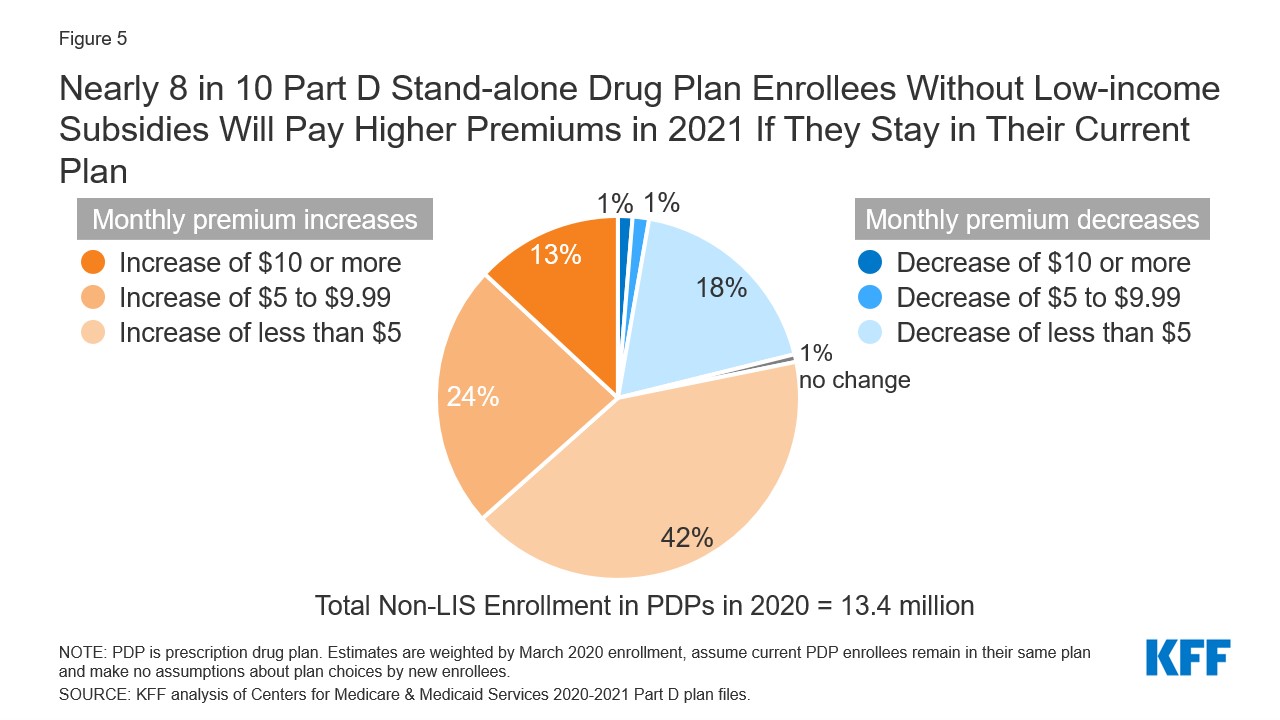

Nearly 8 in 10 Part D Stand-alone Drug Plan Enrollees Without Low-income Subsidies Will Pay Higher Premiums in 2021 If They Stay in Their Current Plan

Figure 5: Nearly 8 in 10 Part D Stand-alone Drug Plan Enrollees Without Low-income Subsidies Will Pay Higher Premiums in 2021 If They Stay in Their Current Plan

Most (78%, or 10 million) of the 13.4 million Part D PDP enrollees who are responsible for paying the entire premium (which excludes Low-Income Subsidy (LIS) recipients) will see their monthly premium increase in 2021 if they stay in their same plan, while 2.8 million (21%) will see a premium reduction if they stay in their same plan (Figure 5).

Nearly 2 million non-LIS enrollees (13%) will see a premium increase of $10 or more per month, while significantly fewer (0.2 million non-LIS enrollees, or 1%) will see a premium reduction of the same magnitude. One-third (34%) of non-LIS enrollees (4.6 million) are projected to pay monthly premiums of at least $60 if they stay in their current plans, and more than 230,000 (2% of non-LIS enrollees) are projected to pay monthly premiums of at least $100.

The Average Monthly Part D Premium in 2021 for the Subset of Enhanced Stand-alone Drug Plans Covering Insulin at a $35 Monthly Copay Is Substantially Higher Than Premiums for Other PDPs

Figure 6: The Average Monthly Part D Premium in 2021 for the Subset of Enhanced Stand-alone Drug Plans Covering Insulin at a $35 Monthly Copay is Substantially Higher than Premiums for Other Plans

New for 2021, beneficiaries in each state will have the option to enroll in a Part D plan participating in the Trump Administration’s new Innovation Center model in which enhanced drug plans cover insulin products at a monthly copayment of $35 in the deductible, initial coverage, and coverage gap phases of the Part D benefit. Participating plans do not have to cover all insulin products at the $35 monthly copayment amount, just one of each dosage form (vial, pen) and insulin type (rapid-acting, short-acting, intermediate-acting, and long-acting).

In 2021, a total of 1,635 enhanced Part D plans will participate in this model, which represents just over 30% of both PDPs (310 plans) and MA-PDs (1,325 plans) available in 2021, including plans in the territories. Between 8 and 10 enhanced PDPs in each region are participating in the model, in addition to multiple MA-PDs (see map). The average premium in 2021 for the subset of enhanced PDPs participating in the insulin $35 copay model ($59) is nearly twice as high as the monthly premium for basic PDPs ($33) and 61% higher than the average premium for enhanced PDPs that are not participating in the model ($37) (weighted by September 2020 enrollment).

Part D Cost Sharing

Part D Enrollees Will Pay Much Higher Cost-Sharing Amounts for Brands and Non-preferred Drugs Than For Drugs on a Generic Tier, and a Mix of Copays and Coinsurance for Different Formulary Tiers

Figure 7: In 2021, Part D Enrollees Will Pay Much Higher Cost-Sharing Amounts for Brands and Non-preferred Drugs than for Drugs on a Generic Tier, and a Mix of Copays and Coinsurance for Different Formulary Tiers

In 2021, as in prior years, Part D enrollees will face much higher cost-sharing amounts for brands and non-preferred drugs (which can include both brands and generics) than for drugs on a generic tier, and a mix of copayments and coinsurance for different formulary tiers (Figure 7). The typical five-tier formulary design in Part D includes tiers for preferred generics, generics, preferred brands, non-preferred drugs, and specialty drugs. Among all PDPs, median standard cost sharing in 2021 is $0 for preferred generics and $5 for generics (an increase from $4 in 2020), $40 for preferred brands (a decrease from $42 in 2020), 40% coinsurance for non-preferred drugs (an increase from 38% in 2020; the maximum allowed is 50%), and 25% coinsurance for specialty drugs (the same as in 2020; the maximum allowed is 33%).

Among the 21 national PDPs, 13 PDPs, covering 9.3 million enrollees as of September 2020, are increasing cost-sharing amounts for drugs on at least one formulary tier between 2020 and 2021 (Table 3). Five PDPs are increasing copayments for generics, with increases ranging from $1 to $4; six PDPs are increasing copayments for preferred brands, with increases ranging from $3 to $10; and 10 PDPs are increasing coinsurance for non-preferred drugs, with increases ranging from 2 percentage points (e.g., from a 38% coinsurance rate to 40%) to 14 percentage points (e.g., from a 35% coinsurance rate to 49%).

Low-Income Subsidy Plan Availability

In 2021, 259 Part D Stand-Alone Drug Plans Will Be Premium-Free to Enrollees Receiving the Low-Income Subsidy (Benchmark Plans)

Figure 8: In 2021, 259 Part D Stand-Alone Drug Plans Will Be Available Without a Premium to Enrollees Receiving the Low-Income Subsidy (“Benchmark” Plans)

In 2021, a larger number of PDPs will be premium-free benchmark plans—that is, PDPs available for no monthly premium to Medicare Part D enrollees receiving the Low-Income Subsidy (LIS)—than in recent years, with 259 premium-free benchmark plans, or roughly a quarter of all PDPs in 2021 (Figure 8). Through the Part D LIS program, enrollees with low incomes and modest assets are eligible for assistance with Part D plan premiums and cost sharing. As of 2020, approximately 13 million Part D enrollees are receiving LIS, including 6.7 million (52%) in PDPs and 6.1 million (48%) in MA-PDs.

On average (weighted by Medicare enrollment), LIS beneficiaries have eight benchmark plans available to them for 2021, or about one-fourth the average number of PDP choices available overall. All LIS enrollees can select any plan offered in their area, but if they enroll in a non-benchmark plan, they must pay some portion of their chosen plan’s monthly premium. In 2021, 10% of all LIS PDP enrollees who are eligible for premium-free Part D coverage (0.6 million LIS enrollees) will pay Part D premiums averaging $33 per month unless they switch or are reassigned by CMS to premium-free plans.

The number of benchmark plans available in 2021 will vary by region, from five to 10 (see map). In 2020, 89% of the 6.6 million LIS PDP enrollees are projected to be in PDPs operated by five firms: CVS Health, Centene, Humana, UnitedHealth, and Cigna (based on 2020 enrollment).

Discussion

Our analysis of the Medicare Part D stand-alone drug plan landscape for 2021 shows that millions of Part D enrollees without low-income subsidies will face premium and other cost increases in 2021 if they stay in their current stand-alone drug plan. There are more plans available nationwide in 2021, with Medicare beneficiaries having 30 PDP choices during this year’s open enrollment period, plus 27 Medicare Advantage drug plan options. Most Part D PDP enrollees who remain in the same plan in 2021 will be in a plan with the standard $445 deductible and will face much higher cost sharing for brands than for generic drugs, including as much as 50% coinsurance for non-preferred drugs.

Some Part D enrollees who choose to stay in their current plans may see lower premiums and other costs for their drug coverage, but nearly 8 in 10 non-LIS enrollees will face higher premiums if they remain in their current plan, and many will also face higher deductibles and cost sharing for covered drugs. Some beneficiaries might find the best coverage and costs for their specific medications in a plan with a relatively low premium, while for other beneficiaries, a higher-premium plan might be more suitable. Because Part D plans vary in a number of ways that can have a significant effect on an enrollee’s out-of-pocket spending, beyond the monthly premium, all Part D enrollees could benefit from the opportunity to compare plans during open enrollment.

Juliette Cubanski is with KFF.

Anthony Damico is an independent consultant.

| Methods |

| This analysis focuses on the Medicare Part D stand-alone prescription drug plan marketplace in 2021 and trends over time. The analysis includes 20.2 million enrollees in stand-alone PDPs, as of March 2020. The analysis excludes 17.4 million MA-PD enrollees (non-employer), and another 4.6 million enrollees in employer-group only PDPs and 2.3 million in employer-group only MA-PDs for whom plan premium and benefits data are unavailable. Data on Part D plan availability, enrollment, and premiums were collected from a set of data files released by the Centers for Medicare & Medicaid Services (CMS): – Part D plan landscape files, released each fall prior to the annual enrollment period – Part D plan and premium files, released each fall – Part D plan crosswalk files, released each fall – Part D contract/plan/state/county level enrollment files, released on a monthly basis – Part D Low-Income Subsidy enrollment files, released each spring – Medicare plan benefit package files, released each fall In this analysis, premium estimates are weighted by September 2020 enrollment unless otherwise noted. Percentage increases are calculated based on non-rounded estimates and in some cases differ from percentage calculations calculated based on rounded estimates presented in the text. |

Tags

Jump to:

BlueJourney Prime (PPO) H3923-017 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Capital Advantage Insurance Company available to residents in Pennsylvania. This plan includes additional Medicare prescription drug (Part-D) coverage. The BlueJourney Prime (PPO) has a monthly premium of $171.00 and has an in-network Maximum Out-of-Pocket limit of $4,000 (MOOP). This means that if you get sick or need a high cost procedure the co-pays are capped once you pay $4,000 out of pocket. This can be a extremely nice safety net.

BlueJourney Prime (PPO) is a Local PPO. A preferred provider organization (PPO) is a Medicare plan that has created contracts with a network of 'preferred' providers for you to choose from at reduced rates. You do not need to select a primary care physician and you do not need referrals to see other providers in the network. Offering you a little more flexibility overall. You can get medical attention from a provider outside of the network but you will have to pay the difference between the out-of-network bill and the PPOs discounted rate.

Capital Advantage Insurance Company works with Medicare to provide significant coverage beyond Part A and Part B benefits. If you decide to sign up for BlueJourney Prime (PPO) you still retain Original Medicare. But you will get additional Part A (Hospital Insurance) and Part B (Medical Insurance) coverage from Capital Advantage Insurance Company and not Original Medicare. With Medicare Advantage Plans you are always covered for urgently needed and emergency care. Plus you receive all of the benefits of Original Medicare from Capital Advantage Insurance Company except hospice care. Original Medicare still provides you with hospice care even if you sign up for a Medicare Advantage Plan.

Ready to Enroll?

Or Call

1-855-778-4180

Mon-Fri 8am-9pm EST

Sat 9am-9pm EST

2021 Capital Advantage Insurance Company Medicare Advantage Plan Costs

| Name: | |

|---|---|

| Plan ID: | H3923-017 |

| Provider: | Capital Advantage Insurance Company |

| Year: | 2021 |

| Type: | Local PPO |

| Monthly Premium C+D: | $171.00 |

| Part C Premium: | $147.4 |

| MOOP: | $4,000 |

| Part D (Drug) Premium: | $23.60 |

| Part D Supplemental Premium | $0 |

| Total Part D Premium: | $23.60 |

| Drug Deductible: | $0 |

| Tiers with No Deductible: | 0 |

| Gap Coverage: | No |

| Benchmark: | not below the regional benchmark |

| Type of Medicare Health: | Enhanced Alternative |

| Drug Benefit Type: | Enhanced |

| Similar Plan: | H3923-028 |

BlueJourney Prime (PPO) Part-C Premium

Capital Advantage Insurance Company plan charges a $147.4 Part-C premium. The Part C premium covers Medicare medical, hospital benefits and supplemental benefits if offered. You generally are also responsible for paying the Part B premium.

H3923-017 Part-D Deductible and Premium

BlueJourney Prime (PPO) has a monthly drug premium of $23.60 and a $0 drug deductible. This Capital Advantage Insurance Company plan offers a $23.60 Part D Basic Premium that is not below the regional benchmark. This covers the basic prescription benefit only and does not cover enhanced drug benefits such as medical benefits or hospital benefits. The Part D Supplemental Premium is $0 this Premium covers any enhanced plan benefits offered by Capital Advantage Insurance Company above and beyond the standard PDP benefits. This can include additional coverage in the gap, lower co-payments and coverage of non-Part D drugs. The Part D Total Premium is $23.60. The Part D Total Premium is the addition of the supplemental and basic premiums for some plans this amount can be lower due to negative basic or supplemental premiums.

Capital Advantage Insurance Company Gap Coverage

In 2021 once you and your plan provider have spent $4130 on covered drugs. (combined amount plus your deductible) You will be in the coverage gap. (AKA 'donut hole') You will be required to pay 25% for prescription drugs unless your plan offers additional coverage. This Capital Advantage Insurance Company plan does not offer additional coverage through the gap.

Premium Assistance

The Low Income Subsidy (LIS) helps people with Medicare pay for prescription drugs, and lowers the costs of Medicare prescription drug coverage. Depending on your income level you may be eligible for full 75%, 50%, 25% premium assistance. The BlueJourney Prime (PPO) medicare insurance offers a $0 premium obligation if you receive a full low-income subsidy (LIS) assistance. And the payment is $5.90 for 75% low income subsidy $11.80 for 50% and $17.70 for 25%.

| Full LIS Premium: | $0 |

|---|---|

| 75% LIS Premium: | $5.90 |

| 50% LIS Premium: | $11.80 |

| 25% LIS Premium: | $17.70 |

H3923-017 Formulary or Drug Coverage

BlueJourney Prime (PPO) formulary is divided into tiers or levels of coverage based on usage and according to the medication costs. Each tier will have a defined copay that you must pay to receive the drug. Drugs in lower tiers will usually cost less than those in higher tiers.By reviewing different Medicare Drug formularies, you can pick a Medicare Advantage plan that covers your medications. Additionally, you can choose a plan that has your drugs listed at a lower price.

2021 BlueJourney Prime (PPO) Summary of Benefits

Additional Benefits

| No |

|---|

Comprehensive Dental

| Diagnostic services | Not covered |

|---|---|

| Endodontics | 50% coinsurance (Out-of-Network) |

| Endodontics | 50% coinsurance |

| Extractions | 50% coinsurance (Out-of-Network) |

| Extractions | 50% coinsurance |

| Non-routine services | 50% coinsurance |

| Non-routine services | 50% coinsurance (Out-of-Network) |

| Periodontics | Not covered |

| Prosthodontics, other oral/maxillofacial surgery, other services | 50% coinsurance (Out-of-Network) |

| Prosthodontics, other oral/maxillofacial surgery, other services | 50% coinsurance |

| Restorative services | 50% coinsurance (Out-of-Network) |

| Restorative services | 50% coinsurance |

Deductible

| $250 annual deductible |

|---|

Diagnostic Tests and Procedures

| Diagnostic radiology services (e.g., MRI) | $125 copay |

|---|---|

| Diagnostic radiology services (e.g., MRI) | $125 copay (Out-of-Network) |

| Diagnostic tests and procedures | $10 copay (Out-of-Network) |

| Diagnostic tests and procedures | $10 copay |

| Lab services | $10 copay |

| Lab services | $10 copay (Out-of-Network) |

| Outpatient x-rays | $20 copay |

| Outpatient x-rays | $20 copay (Out-of-Network) |

Doctor Visits

| Primary | $5 copay per visit |

|---|---|

| Primary | $5 copay per visit (Out-of-Network) |

| Specialist | $25 copay per visit (Out-of-Network) |

| Specialist | $25 copay per visit |

Emergency care/Urgent Care

| Emergency | $90 copay per visit (always covered) |

|---|---|

| Urgent care | $35 copay per visit (always covered) |

Foot Care (podiatry services)

| Foot exams and treatment | $25 copay (Out-of-Network) |

|---|---|

| Foot exams and treatment | $25 copay |

| Routine foot care | Not covered |

Ground Ambulance

| $150 copay |

|---|

| $150 copay (Out-of-Network) |

Hearing

| Fitting/evaluation | 50% coinsurance (Out-of-Network) |

|---|---|

| Fitting/evaluation | $0 copay |

| Hearing aids | $0 copay (Out-of-Network) |

| Hearing aids | $0 copay |

| Hearing exam | $25 copay |

| Hearing exam | $25 copay (Out-of-Network) |

Lis Levels For 2021

Inpatient Hospital Coverage

| $100 per day for days 1 through 6 $0 per day for days 7 through 90 (Out-of-Network) |

|---|

| $100 per day for days 1 through 6 $0 per day for days 7 through 90 |

Medical Equipment/Supplies

| Diabetes supplies | $0 copay per item |

|---|---|

| Diabetes supplies | 20% coinsurance per item (Out-of-Network) |

| Durable medical equipment (e.g., wheelchairs, oxygen) | 20% coinsurance per item |

| Durable medical equipment (e.g., wheelchairs, oxygen) | 20% coinsurance per item (Out-of-Network) |

| Prosthetics (e.g., braces, artificial limbs) | 20% coinsurance per item (Out-of-Network) |

| Prosthetics (e.g., braces, artificial limbs) | 20% coinsurance per item |

Medicare Part B Drugs

| Chemotherapy | 20% coinsurance (Out-of-Network) |

|---|---|

| Chemotherapy | 20% coinsurance |

| Other Part B drugs | 20% coinsurance (Out-of-Network) |

| Other Part B drugs | 20% coinsurance |

2021 Lis Copays Tax

Mental Health Services

| Inpatient hospital - psychiatric | $100 per day for days 1 through 6 $0 per day for days 7 through 90 (Out-of-Network) |

|---|---|

| Inpatient hospital - psychiatric | $100 per day for days 1 through 6 $0 per day for days 7 through 90 |

| Outpatient group therapy visit | $30 copay |

| Outpatient group therapy visit | $30 copay (Out-of-Network) |

| Outpatient group therapy visit with a psychiatrist | $30 copay |

| Outpatient group therapy visit with a psychiatrist | $30 copay (Out-of-Network) |

| Outpatient individual therapy visit | $30 copay (Out-of-Network) |

| Outpatient individual therapy visit | $30 copay |

| Outpatient individual therapy visit with a psychiatrist | $30 copay (Out-of-Network) |

| Outpatient individual therapy visit with a psychiatrist | $30 copay |

MOOP

| $6,000 In and Out-of-network $4,000 In-network |

|---|

Option

| No |

|---|

Optional supplemental benefits

| No |

|---|

Outpatient Hospital Coverage

| $225 copay per visit (Out-of-Network) |

|---|

| $225 copay per visit |

Preventive Care

| $0 copay |

|---|

| 20% coinsurance (Out-of-Network) |

Preventive Dental

| Cleaning | Covered under office visit |

|---|---|

| Dental x-ray(s) | Covered under office visit |

| Fluoride treatment | Not covered |

| Office visit | 50% coinsurance (Out-of-Network) |

| Office visit | $10.00 |

| Oral exam | Covered under office visit |

Rehabilitation Services

| Occupational therapy visit | $25 copay |

|---|---|

| Occupational therapy visit | $25 copay (Out-of-Network) |

| Physical therapy and speech and language therapy visit | $25 copay |

| Physical therapy and speech and language therapy visit | $25 copay (Out-of-Network) |

Skilled Nursing Facility

| $0 per day for days 1 through 20 $160 per day for days 21 through 100 (Out-of-Network) |

|---|

| $0 per day for days 1 through 20 $160 per day for days 21 through 100 |

Transportation

| 50% coinsurance (Out-of-Network) |

|---|

| $0 copay |

Vision

| Contact lenses | $0 copay |

|---|---|

| Contact lenses | $0 copay (Out-of-Network) |

| Eyeglass frames | $0 copay |

| Eyeglass frames | $0 copay (Out-of-Network) |

| Eyeglass lenses | $0 copay (Out-of-Network) |

| Eyeglass lenses | $0 copay |

| Eyeglasses (frames and lenses) | Not covered |

| Other | Not covered |

| Routine eye exam | $20 copay |

| Routine eye exam | 50% coinsurance (Out-of-Network) |

| Upgrades | Not covered |

Wellness Programs (e.g. fitness nursing hotline)

| Covered |

|---|

Reviews for BlueJourney Prime (PPO) H3923

| 2019 Overall Rating |

|---|

| Part C Summary Rating |

| Part D Summary Rating |

| Staying Healthy: Screenings, Tests, Vaccines |

| Managing Chronic (Long Term) Conditions |

| Member Experience with Health Plan |

| Complaints and Changes in Plans Performance |

| Health Plan Customer Service |

| Drug Plan Customer Service |

| Complaints and Changes in the Drug Plan |

| Member Experience with the Drug Plan |

| Drug Safety and Accuracy of Drug Pricing |

Staying Healthy, Screening, Testing, & Vaccines

| Total Preventative Rating |

|---|

| Breast Cancer Screening |

| Colorectal Cancer Screening |

| Annual Flu Vaccine |

| Improving Physical |

| Improving Mental Health |

| Monitoring Physical Activity |

| Adult BMI Assessment |

Managing Chronic And Long Term Care for Older Adults

| Total Rating |

|---|

| SNP Care Management |

| Medication Review |

| Functional Status Assessment |

| Pain Screening |

| Osteoporosis Management |

| Diabetes Care - Eye Exam |

| Diabetes Care - Kidney Disease |

| Diabetes Care - Blood Sugar |

| Rheumatoid Arthritis |

| Reducing Risk of Falling |

| Improving Bladder Control |

| Medication Reconciliation |

| Statin Therapy |

Member Experience with Health Plan

| Total Experience Rating |

|---|

| Getting Needed Care |

| Customer Service |

| Health Care Quality |

| Rating of Health Plan |

| Care Coordination |

Member Complaints and Changes in BlueJourney Prime (PPO) Plans Performance

| Total Rating |

|---|

| Complaints about Health Plan |

| Members Leaving the Plan |

| Health Plan Quality Improvement |

| Timely Decisions About Appeals |

Health Plan Customer Service Rating for BlueJourney Prime (PPO)

| Total Customer Service Rating |

|---|

| Reviewing Appeals Decisions |

| Call Center, TTY, Foreign Language |

BlueJourney Prime (PPO) Drug Plan Customer Service Ratings

| Total Rating |

|---|

| Call Center, TTY, Foreign Language |

| Appeals Auto |

| Appeals Upheld |

Ratings For Member Complaints and Changes in the Drug Plans Performance

| Total Rating |

|---|

| Complaints about the Drug Plan |

| Members Choosing to Leave the Plan |

| Drug Plan Quality Improvement |

Member Experience with the Drug Plan

| Total Rating |

|---|

| Rating of Drug Plan |

| Getting Needed Prescription Drugs |

Drug Safety and Accuracy of Drug Pricing

| Total Rating |

|---|

| MPF Price Accuracy |

| Drug Adherence for Diabetes Medications |

| Drug Adherence for Hypertension (RAS antagonists) |

| Drug Adherence for Cholesterol (Statins) |

| MTM Program Completion Rate for CMR |

| Statin with Diabetes |

2021 Lis Copays Limits

Ready to Enroll?

Or Call

1-855-778-4180

Mon-Sat 8am-11pm EST

Sun 9am-6pm EST

Coverage Area for BlueJourney Prime (PPO)

(Click county to compare all available Advantage plans)

| State: | Pennsylvania |

|---|---|

| County: | Adams,Berks,Centre,Columbia,Cumberland, Dauphin,Franklin,Fulton,Juniata, Lancaster,Lebanon,Lehigh,Mifflin, Montour,Northampton,Northumberland,Perry, Schuylkill,Snyder,Union,York, |

Go to top

2021 Lis Copays

Source: CMS.

Data as of September 9, 2020.

Notes: Data are subject to change as contracts are finalized. For 2021, enhanced alternative may offer additional cost sharing reductions in the gap on a sub-set of the formulary drugs, beyond the standard Part D benefit.Includes 2021 approved contracts. Employer sponsored 800 series and plans under sanction are excluded.